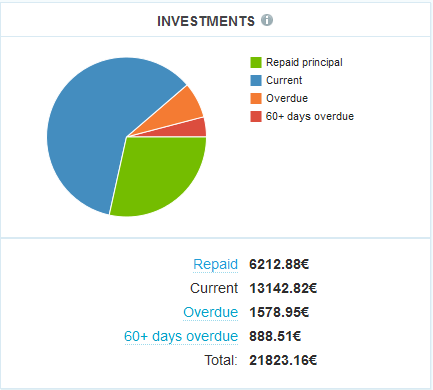

I started p2p lending at Bondora (formerly Isepankur) in the end of 2012. Since then I periodically wrote on my experiences – you can read my last report here. Since the start have deposited 13,000 Euro (approx. 17,600 US$). My portfolio is very diversified. Most loan parts I hold are for loan terms between 36 and 60 months. Together the loans add up to 15,610 Euro outstanding principal. Loans in the value of 1,579 Euro are overdue, meaning they (partly) missed one or two repayments. 888 Euro are in loans that are more than 60 days late. I already received 6,212 Euro in repaid principal back (which I reinvested).

Chart 1: Screenshot of loan status

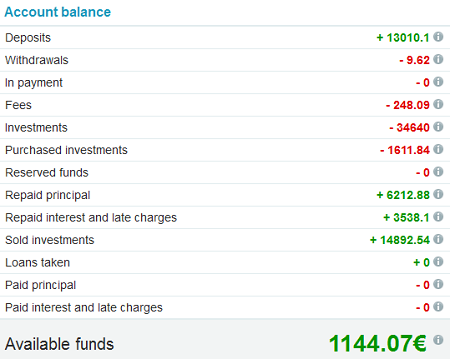

Right now I have a high amount of cash in the account – 1,144 Euro. I’ll explain what led to this situation later on.

Chart 2: Screenshot of account balance

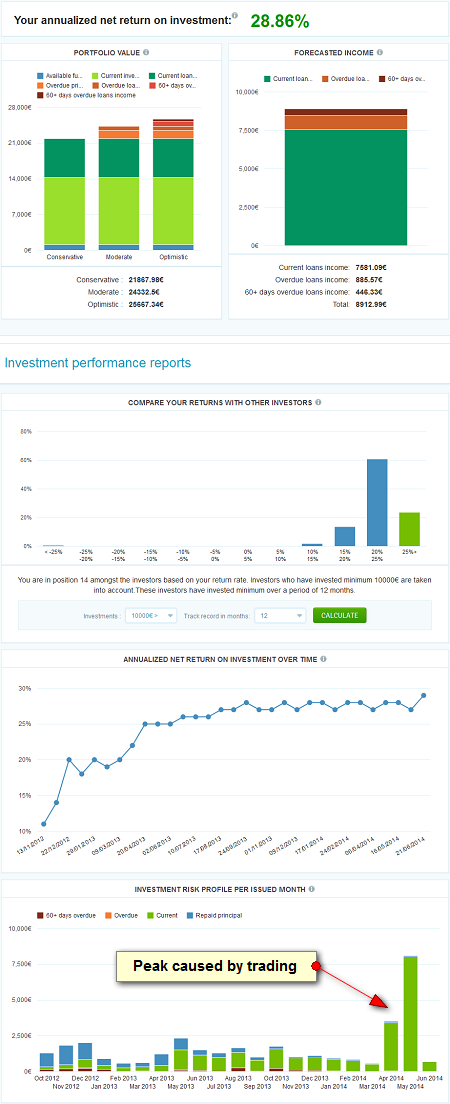

Return on Invest

Currently Isepankur shows my ROI to be over 28.8% (sidenote: I and several others observed that trading had no impact on the ROI shown. Then our ROI suddenly jumped on June 19th; we assume Bondora changed the calculation then to account (better?) for capital gains; here is an example of a portfolio with very big impact of trading). In my own calculations, using XIRR in Excel, I currently get a 25.9% ROI. Even if I assume that 50% of my 60+days overdue will not be recovered (past recovery rates reported by Bondora have been high) my ROI still calculates to 23.2% .

Chart 3: Statistics on ROI and funded volume

Bondora+ loans and my experiments in trading

In April Bondora launched a new offer, named Bondora+. Bondora+ loans are directed at more experienced investors. They have higher default risks as Bondora is not conducting the same amount of checks as with the other loans. The main difference is that the borrower does not have to submit bank statements for the past months. In exchange for the higher risks Bondora+ loans are listed with higher interest rates. On Bondora+ loans there is only manual bidding (no profile bidding). Each investor has to acknowledge the risks once when making the first bid on a Bondora+ loan.

Like with any new product, I was more than eager to try it. But what to do? I decided to go for a new strategy. Rather than just investing in these loans I settled for a trading strategy. I invested with the purpose of selling the loan parts for profit (through the premium) on the secondary market. Of course this trading strategy meant much higher risk than just investing as I was now going to invest in many parts of the same loan meaning risk concentration rather instead of risk diversification. It was also very unclear at this stage whether I would find buyers at premium for all my loan parts.

My main considerations at start were:

- I wanted to sell all parts before first repayment date. If I achieve that I bear no default risk (as this is a new loan class the default rate is unknown)

- The open positions need close monitoring. Both on individual loan basis as for the whole lot of Bondora+ loan parts. My maximum amount of all Bondora+ loan parts together at one point in time did not exceed 3,000 Euro. This exposure defined the maximum loss risk.

- For ROI considerations a most important factor is how fast the parts sell. I wanted to optimize this by trying to sell at 3% premium instead of the 5% maximum possible as I suspected other investors might try trading to and with a moderate premium I would have higher chances in selling (before them).

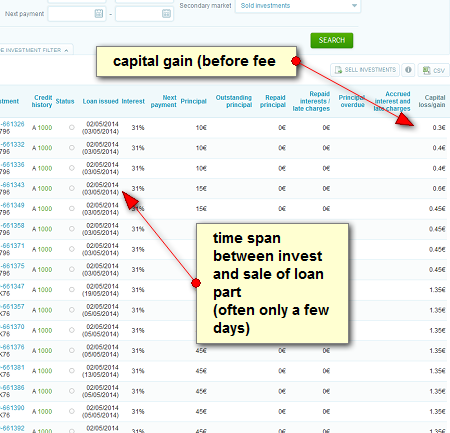

I had some more considerations on borrower age, loan amount and DTI but won’t go into even more detail. Off I went. I invested in mainly A1000 Bondora+ loans from all countries. I invested in multiple loan parts of each loan (sometimes up to 1,500 Euro per loan). Since I wanted also to gain experience whether the loan part size was important I had loan parts spread in sizes mainly between 10 and 50 Euros.

Phase I: April till mid/end May

The strategy worked very satisfying initially. The main challenge was to find enough loan parts to invest into. For that reason I dropped some of the DTI and age considerations in the course and also went as high as 65 Euro per loan part.

Chart 4: Sample of sold loans. Shows the variations in how long I held loan parts.

My learnings:

- I succeeded selling all parts in that phase. Most with 3% premium. A few (mostly Estonian ones) with 4 or 5% markup.

- I was never able to predict how fast parts would sell. Sometimes within hours, sometimes it took weeks.

- There seemed to be no correlation between certain loan parameters (amount, age, dti, whatever) and the attraction of buyers. Only that Estonian parts sold faster than Finnish or Spanish ones.

- Contrary to my expectations size of loan parts did not matter either. My 45 Euro parts sold just as quick as the 10 Euro parts

- The whole strategy was dependant on a very low number of buyers. Crucial were those buyers that bought dozens of my parts in one transaction (see chart 5 for example). This somewhat explains the previous point.

Curiosity side note: There was one Estonian loan in the market which was marked as “Nothing is verified”. I even invested in that loan speculating Bondora must have had good reason to approve it. Those loan parts were shown with a stunning bright red sign in the resale. Nevertheless all of them sold. Later Bondora said the classification was an error and this loan now states “Income & expenses verified through bank statements”

Chart 5: The Bondora+ loans sell off in large chunks, with few buyers taking the majority of parts

During that phase of about 6 weeks I sold about 8,500 Euro in loan parts for an estimated profit of about 160 Euro (around 280 Euro capital gains less 127.50 sales fees). Considering that I never had more than 3,000 Euro invested that translates to a staggering yield of about 5% for the six weeks or more than 50% p.a..

Phase II: mid/end May till now

In the second half of May tides turned. Suddenly there were more Spanish and Finnish Bondora+ loans available on the primary market than investor money was flowing into them. Naturally sales on the secondary market all but stopped. Why buy at premium when you can have similar loan parts on the primary market without any fees or markups? I still sold a few parts, but it became clear that I would likely be stuck with those Bondora+ loans that I had in my portfolio until the first repayment date.

I spoke to other investors that I knew were trading. While they also did not sell much anymore some of them felt less impacted as their planning had included the possibility to hold parts for a couple of repayments, to supplement the trading gains with the income from the high interest. So essentially they did change nothing and are waiting how the first repayments go.

I reduced my premiums to 2% and on one loan, where the repayment is due on June 25th to zero or 1% markup for some parts to reduce my exposure (you are welcome to buy them). I sold some parts but not many. I currently hold 2,520 Euro in Bondora+ parts, mainly in 2 Finnish, 1 Spanish and 1 Estonian loan. So I might even put some parts on sale at a slight discount later. If not, I ask you to keep your fingers crossed for me that these 4 loans make their first repayment.

My current conclusion is, that the possible profits of trading Bondora+ loans are not worth the risk. That may change once more figures are available on how Bondora+ loans do (check this interesting article too) and/or the demand outweights the supply for a longer period of time.

Overall experiences in the past 3 months

My lending experience had been smooth from 2012 through to the beginning of 2014. If I wanted to I could rely on my profiles to invest my money and my repayments on Bondora without much time spent. All this has changed now. Investing is becoming much more work. Everybody had a hard time understanding the new queue system and as investor demand is by far outweighting loan demand for the most attractive loans (EE A1000), it is getting much harder to get the available cash invested. Some investors focussed on buying loans on the secondary market where more than 10,000 loan parts are available. I do this occasionaly but find the filters lacking and the practise to time consuming.

Bondora is now tweaking the market environment more frequently than in the past. Last week Bondora announced a new pricing:

Estonia – minimum interest rate 15%, standard rate 26%

Spain – minimum interest rate 26%, standard rate 26%

Slovakia – minimum interest rate 26%, standard rate 26%

Finland – minimum interest rate 19%, standard rate 26%

In Spain and Slovakia only loans with a 1000 credit score come to the market.

The upside of Bondora is that all the loan data is for download. Together with all the data on the resale market (which currently cannot be analysed automatically) there is so much data to test and refine strategies. And overall lender ROIs are still outstanding, though the upward creeping default rates need to be watched and the recoveries monitored. What do you think? Share your opinion in the forum.

Nice read. I was wondering if the bondora+ flipping would be worth it back in the beginning, but seems that it was too high risk even back then. Even with the absolute best loans the exposure would be too much and too risky imho.

PS! Thanks for sharing my post. Did it make any sense with Google translation though?

Translating it to English Google Translate does okay. If you attempt to translate from Estonian to German it is not understandable.

Hello,

where is bondora+, there is another site for bondora+, I dont see what is bondora, and what is bondora+.

Could you explain me, what does it means Bondora+?

Thanks,

John

Hi John,

same site; just a different type of loans. To see how you recognize Bondora+ loans look at the first picture in this article.

Thanks for the update. I dont know much about this new queue system. How should one invest, when things has become this difficult?

It’s great that someone is sharing their information on trading.

I feel that B+ loans might be more/less attractive depending on the growth cycles that Bondora goes through. Moments when there is high demand and a low listing of loans people are more willing to buy. I still feel that Estonian B+ loans should be easy to sell off due to high demand for them. (I have picked up some myself.) For Spanish and Finnish B+ loans I totally see why people are keeping away from them since there isn’t even any separate data on the verified loans’ returns.