It’s been 14 months now since I started a p2p lending portfolio at Isepankur. I feel confident now, that I understand fairly well how to get above average results. During the first months I usually logged in at least daily and watched bidding patterns and resale activity to learn how the other lenders made use of the instruments. I also did a lot of micromanagement at that time. Lately I think I could satisfy my information thirst by logging in once or twice a week. Some of my automated bidding profiles have been running unchanged for weeks or months. I do still spend a big amount of time on p2p lending related news & forums (but not limited to Isepankur).

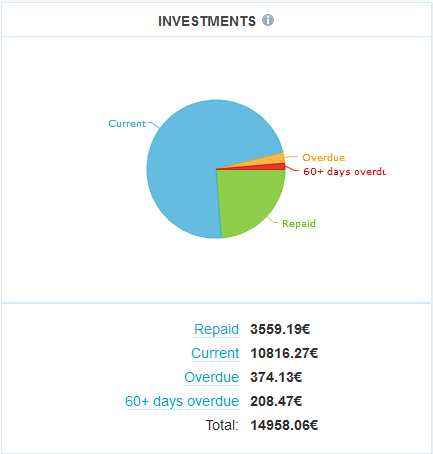

I have deposited 10,000 Euro (approx. 13,500 US$) since starting in the end of 2012. I hold over 600 loan parts – the diversification achieved is very good. Together the loans add up to 11,399 Euro outstanding principal. Loans in the value of 347 Euro are overdue, meaning they (partly) missed one or two repayments. 208 Euro are in loans that are more than 60 days late. I already received 3,559 Euro in repaid principal back (which I reinvested).

Chart 1: Screenshot of loan status

Right now I have 290 Euro cash in the account which is much more than my usual cash position. 165 Euro are tied in bids on current loan listings and will originate in the next few days.

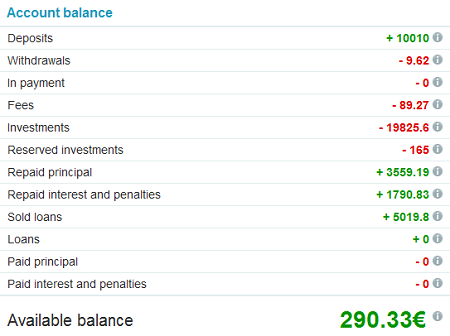

Chart 2: Screenshot of account balance

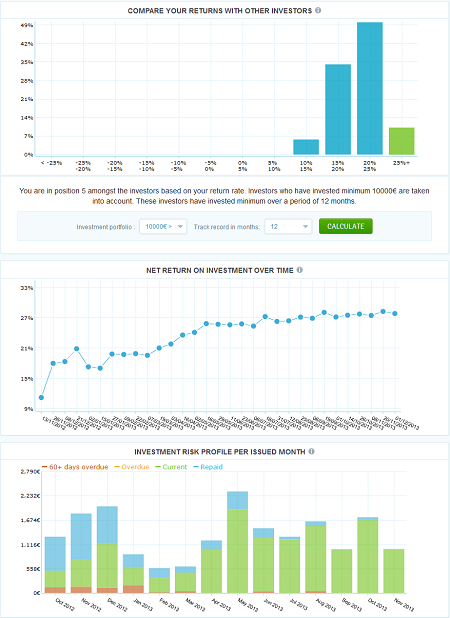

Return on Invest

Currently Isepankur shows my ROI to be over 27% (see chart 3 ). In my own calculations, using XIRR in Excel, I currently get a 24.4% ROI. In the first months there was a considerable gap when comparing these differently calculated ROI figures. As my portfolio ages, the gap is closing. The statistic section tells me, that I am currently the lender with the 5th best ROI (counting all lenders that have invested for at least 12 months and at least 10,000 Euro).

Chart 3: Statistics on ROI and funded volume

Isepankur announced opening to borrowers in Slovakia

Very soon Isepankur will also list loans to borrowers in Slovakia, a small eastern European country with a population of 5.5 million. I will bid on very few select loans to gain some experience. My loaned amount to Finnish and Spanish borrowers is only 100 Euro – less than 1% of my portfolio.

Dein Portfolio entwickelt sich ja hervorragend! Hätte nicht erwartet. Die Verzugsraten nach 14 Monaten ist ja traumhaft.

Hast du mir volt Details von deinen verkauften Anteilen. Also wie hoch dort inzwischen die overdue bzw default rate ist. Würde mich sehr interessieren.

Hi Shady,

the principal of my sold loans is 5,068 Euro (does not match screenshot as some time has passed now). Balance of sold loans is 3,902 Euro (for the people who bought them) now. Of this 854 Euro (24%) is overdue, inlcuding 488 Euro (12%) loans which are 60+ days overdue.

I didn’t only sell loans to avoid defaults/overdues. I commonly sold them to gain the premiums, too. See my previous reviews.

HI

How come you have -19825 Investments and only 10k deposits ? Is this because you are re investing the profits ?

What is your average investment per loan ?

Thanks

>Is this because you are re investing the profits ?

Yes. Furthermore the 19285 include the 5019 sold loan parts ( I do not own those any more). Therefore “Investments” includes everthing invested into in the past (originated or bought), regardless if it has been repaid or sold meanwhile.

In the Account at >investments >investments it is possible to see the prinicpal and balance of loans still owned.

> What is your average investment per loan ?

I typically invest between 10 and 40 Euro per loan. The average is currently about 22 Euro (per investment at origination time); respective approx 17 Euro (outstanding balance)

hello,

I’ve been following your investing route on isepankur since the beginning and started investing aswell.

Have you already tried to withdraw some money? Is this a troubleless procedure? I haven’t found anyone talking about it on the net.

regards.

I tested withdrawal right at the beginning and withdrew 10 Euro. Isepankur charges a fee of 0.38 Euro per withdrawal. The remaining 9.62 Euro arrived within 1 or 2 days in my bank account. You can see the withdrawal amount in chart 2 of the article above. Note that as a safeguard you can only withdraw money to the SAME bankaccount you used for funding.

hello,

really great and informative articles, thank you!

I have 2 questions:

1) why do you avoid borrowers from Finland and Spain? I guess Spain is more or less understandable, but Finland economically is much better and stronger than Estonia, salaries are bigger also.

2) do you still invest only in loans with period of 12-36 months, or do you also invest in 50 month loans?

Thank you.

Hi Chris,

concerning Finland there is some ongoing discussion on the Isepankur forum regarding possible risks/delays in collections.

The vast majority of my loan parts are for durations between 36 and 60 months.

I’ have a question for you according taxes.

Are they giving you a document with the certification about money gained every year. Because you have to pay taxes on it. Right?

I’d like to try isepankur but i don’t want tax problem in my country.

Is it too complicated to deal with this or not really?

Thank you for your answer

There is an income report, where you can see interest earned for the last year. You can print this report.

Thank you for great article.

1. Have you tried Slovakia yet (currently none listed)?

2. Can you explain why are you not investing in Finland /Spain?

Hi Martin,

we all still wait for the first Slovakian loan to appear. I’ll put small amount in a few Slovakian loans to gather some first hand experience.

As for Finland/Spain. I am cautious as there is no track record (yet). Since I am very satisfied with the ROI on the Estonian loans I achieve (and there is a track record there) I’ll continue to concentrate on the Estonian loans. That might change in a few month after the new marktets have been tested and more experiences gathered.

I have to say that isep have a very good site and business model.The authorities in Estonia also appear to be “robust” in the collection of bad debts.This is re-assuring and another good reason to concentrate on Estonian lenders until we have more experience of Finnish and Spanish standards.Any news on the Slovakian loans?

Also,do similar sites operate in other European countries and open to all?

Would hope that in due course isep will introduce more useful filters as described above.It really is too time consuming when trying to buy loan parts in the secondary market.

Happy Investing

How did you manage to sell as many loans? Do you put all your loans for sale? Re selling them at a higher amount?

No, only select ones.

But there was a time last year, when I bought multiple laon parts of each loan and instantly resold them at premium. See this article:

https://www.p2p-banking.com/countries/baltic-my-p2p-lending-loan-portfolio-at-isepankur-after-8-month/